rogervivieroutlet.ru

Community

Ira And Roth Ira Rules

The Roth IRA contribution limit for is $7, for those under 50, and an additional $1, catch up contribution for those 50 and older. The contribution limit for both types of IRAs is $6, in , and $7, if you are over With a Roth IRA, contributions grow tax-free, whereas in a. Roth IRA contributions are made on an after-tax basis. · Tax Year - $6, if you're under age 50 / $7, if you're age 50 or older. · Tax Year -. Eligibility Requirements for Roth IRA Contributions You must have earned income (compensation) in order to contribute to a Roth IRA. There is no age. A Roth IRA differs from a traditional IRA in that it pays off For both traditional and Roth IRAs, the rules diverge on when you must start withdrawals. Roth IRA distribution rules · You're at least 59 1/2 years old. · You're totally and permanently disabled. · You're withdrawing up to $10, for a first-time. Withdrawals from a Roth IRA you've had less than five years. If you haven't met the five-year holding requirement, your earnings will be subject to taxes but. Access: Although Roth IRAs are designed for retirement savings, you can access contributions at any time without taxes or penalty. Tax-free income: A Roth IRA. In , you can contribute up to $, or $ if you're age 50 or older, to all of your Roth and traditional IRA accounts. The Roth IRA contribution limit for is $7, for those under 50, and an additional $1, catch up contribution for those 50 and older. The contribution limit for both types of IRAs is $6, in , and $7, if you are over With a Roth IRA, contributions grow tax-free, whereas in a. Roth IRA contributions are made on an after-tax basis. · Tax Year - $6, if you're under age 50 / $7, if you're age 50 or older. · Tax Year -. Eligibility Requirements for Roth IRA Contributions You must have earned income (compensation) in order to contribute to a Roth IRA. There is no age. A Roth IRA differs from a traditional IRA in that it pays off For both traditional and Roth IRAs, the rules diverge on when you must start withdrawals. Roth IRA distribution rules · You're at least 59 1/2 years old. · You're totally and permanently disabled. · You're withdrawing up to $10, for a first-time. Withdrawals from a Roth IRA you've had less than five years. If you haven't met the five-year holding requirement, your earnings will be subject to taxes but. Access: Although Roth IRAs are designed for retirement savings, you can access contributions at any time without taxes or penalty. Tax-free income: A Roth IRA. In , you can contribute up to $, or $ if you're age 50 or older, to all of your Roth and traditional IRA accounts.

Direct contributions to a Roth IRA (principal) may be withdrawn tax and penalty-free at any time. · Up to a lifetime maximum $10, in earnings, withdrawals are. With Roth IRAs, however, you pay taxes upfront by contributing after-tax dollars and later in retirement your withdrawals are tax-free (as long as your account. In , the contribution limit was $6,, or $7, for those 50 or older. Your individual contribution limit is determined based on your filing status and. Generally, a Roth IRA conversion makes sense if you: · Won't need the converted Roth funds for at least five years. · Expect to be in the same or a higher tax. There are no penalties on withdrawals of Roth IRA contributions. But there's a 10% federal penalty tax on withdrawals of earnings. With a traditional IRA. For Pennsylvania personal income tax purposes, the following rules apply: • Amounts rolled over into IRAs from non-IRA individual retirement plans are generally. Am I Eligible?Expand · Full contribution if MAGI is less than $, (single) or $, (joint) · Partial contribution if MAGI is between $, and. Traditional or Roth IRA? · With a traditional IRA, contributions may be tax-deductible and the assets have the potential to grow tax-deferred. However, the. There are some income limitations for Roth IRAs. You'll find current limits on the IRS website. There is no minimum or maximum age for contributing to a Roth. If you withdraw from your Roth IRA at age 59½ or older and have owned your account for at least 5 years,** your withdrawals come out tax free.* Since. Roth IRAs are funded with after-tax dollars. Unlike a traditional IRA, the contributions are not tax-deductible, but once you start withdrawing funds, the money. Yes, you're eligible for a Roth IRA, in , if you earned less than $, and file taxes alone or $, and file jointly. Are Roth IRA withdrawals tax-. A Roth IRA is one type of IRA account. Roth IRAs are funded with after-tax dollars and contributions grow tax free. Roth IRA withdrawals are also tax free if. The contribution limits for Roth IRAs · For , $6,, or $7, if you're age 50 or older by the end of the year; or your taxable compensation for the year. You can withdraw up to your total contribution amount at any time, without fear of taxes or penalties. For example, if you have contributed $50, to your Roth. You may have both types of IRAs, but your annual contribution for all IRA accounts is capped at $6, total for investors under 50 and $7, for those 50 and. Contributions: Because your Roth IRA contributions are made with after-tax dollars, you can withdraw your regular contributions (not the earnings) at any time. Roth IRA contributions · Begin to phase out when your MAGI reaches $, if you are Single or Head of Household, or $, if Married Filing Jointly · Is. Income limits for Roth IRA contributions: · There are no income limits for converting Traditional IRA assets to a Roth IRA. · For married taxpayers filing.

Value My Startup

Startup valuation is the process of calculating the value of a startup company. Startup valuation methods are particularly important because they are typically. Use rogervivieroutlet.ru to value your startup just like a VC, Angel PE firm or investor. Our startup valuations are free, fast and accurate. Below we provide some start-up-specific information that will help you to understand and ensure a reasonable estimation of your start-up business value. Berkus method · 20% method: The best way to value your equity is the 20% method. · Ask around: Read up, ask around, look at trends, see how you fit in the box. Having a strong customer base is essential for your startup's success as it is a common proxy for revenue. Investors will want to invest in a business that. The five most common startup valuation methods include the scorecard, comparable transactions, cost-to-duplicate, discounted cash flow and the market multiple. Some of the more common valuation approaches for startups include the market approach, income approach and Berkus method. The easiest way would be to compare yourself to their (and any other founders) contribution to the startup. How much time and capital, compared. You can value your company, even in the earliest startup phases, by looking at similar companies in your industry and geographic location and their valuations. Startup valuation is the process of calculating the value of a startup company. Startup valuation methods are particularly important because they are typically. Use rogervivieroutlet.ru to value your startup just like a VC, Angel PE firm or investor. Our startup valuations are free, fast and accurate. Below we provide some start-up-specific information that will help you to understand and ensure a reasonable estimation of your start-up business value. Berkus method · 20% method: The best way to value your equity is the 20% method. · Ask around: Read up, ask around, look at trends, see how you fit in the box. Having a strong customer base is essential for your startup's success as it is a common proxy for revenue. Investors will want to invest in a business that. The five most common startup valuation methods include the scorecard, comparable transactions, cost-to-duplicate, discounted cash flow and the market multiple. Some of the more common valuation approaches for startups include the market approach, income approach and Berkus method. The easiest way would be to compare yourself to their (and any other founders) contribution to the startup. How much time and capital, compared. You can value your company, even in the earliest startup phases, by looking at similar companies in your industry and geographic location and their valuations.

The pre-money valuation and the amount invested determine the investor's ownership percentage following the investment. To determine a value for an early-stage. The most common method that investors use to value startups is the discounted cash flow (DCF) method. With this method, investors estimate the. Valuation ranges for pre-seed startups · million: average valuation in smaller European markets, Latin America or teams with less experience or targeting. How to calculate the valuation of startup? · Multiple of Revenue Method: Multiply the annual revenue by a certain number to estimate the. Determining the value of a young tech company with little or no revenue is difficult. SVB examines the ways investors evaluate seed round startups. Startup valuation is a science of approximation and can only yield a relative number, not an absolute one. It's a snapshot of a young company's potential that. Calculating the value of your startup is a notoriously murky field, no more so than at the earlier stages where there is little track record to help guide you. So where should you aim to value your startup? Our point of view is to look at industry public and M&A exit revenue multiples. You may be. Investors can value the startup at 10x EBITDA for example, with 10 being the valuation multiple. The valuation multiple is determined based on the market. How do angels and VCs value their potential startup portfolio companies? Many angels and VCs value startups based on the percentage of the startups such. Take advantage of our free startup valuation calculator by answering the following 25 questions, and we'll calculate an approximate valuation range for you. The most common method that investors use to value startups is the discounted cash flow (DCF) method. With this method, investors estimate the. Valuing a startup requires forward-looking analysis and forecasting. Since startups operate in a dynamic and rapidly evolving environment, their value is. Valuing a startup without any existing revenue can be difficult. So difficult in fact that most Venture Capitalists and Angel Investors admit that a certain. Lighter Capital's free startup valuation calculator uses the latest market data, insights from our own investment portfolio, and over a decade of experience. Investors determine that the post-money valuation—after their $5 million investment—is $25 million. The overall valuation of the company has increased. But. You can value your company, even in the earliest startup phases, by looking at similar companies in your industry and geographic location and their valuations. AngleList and CrunchBase are good places to get accurate startup valuation data. Search each site for the top 10 startup companies in your industry and filter. Startup valuation is the process of calculating the value of a startup company. business idea, you automatically add value to your startup. Investors start. Valuing a startup requires forward-looking analysis and forecasting. Since startups operate in a dynamic and rapidly evolving environment, their value is.

Pr Software Tools

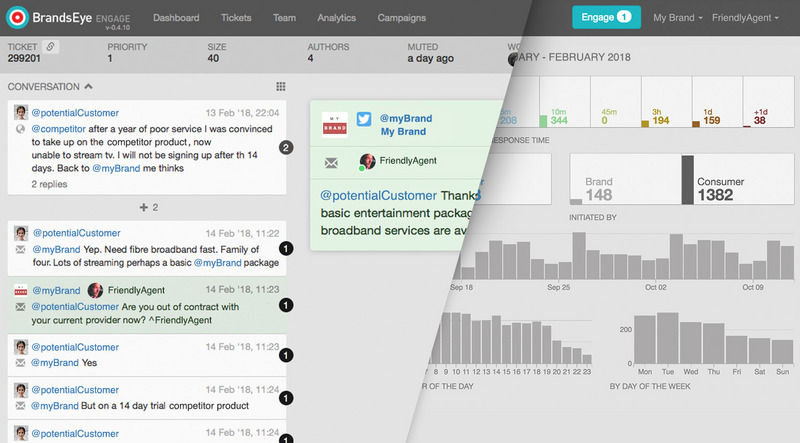

Brand24 is one of the best and most comprehensive public relations software. In its essence, this media monitoring tool allows you to track all public mentions. Deep Dive Into Your Performance With Comprehensive PR Reporting Tools Gain deeper insights with our seamlessly customizable, exportable and easy-to-edit. Anyone knows what the best PR tool is between Meltwater, Cision and Prowly? I've had demos with all of them and I'm leaning towards Meltwater. Competitor PR Monitoring · Social Media Tracker · Monitor Your Competitors' PR Activities with Semrush Tools · FAQ on Semrush's Competitor PR Monitoring Tools. PR software helps boost your credibility, and nurture brand trust and love. Tools you should have a look at: rogervivieroutlet.ru, Agility PR, Cision, Meltwater, Lexis. Try the leading Public Relations Management software. Start increasing media coverage, save time, track performance & measure ROI from PR. The guide includes tools for: Planning your comms strategy, Creating great PR content, Managing all your news, coverage, and media assets. Respona is the all-in-one PR outreach software that enables brands to connect with relevant journalists and bloggers, in a matter of minutes. PR software helps boost your credibility, and nurture brand trust and love. Tools you should have a look at: rogervivieroutlet.ru, Agility PR, Cision, Meltwater, Lexis. Brand24 is one of the best and most comprehensive public relations software. In its essence, this media monitoring tool allows you to track all public mentions. Deep Dive Into Your Performance With Comprehensive PR Reporting Tools Gain deeper insights with our seamlessly customizable, exportable and easy-to-edit. Anyone knows what the best PR tool is between Meltwater, Cision and Prowly? I've had demos with all of them and I'm leaning towards Meltwater. Competitor PR Monitoring · Social Media Tracker · Monitor Your Competitors' PR Activities with Semrush Tools · FAQ on Semrush's Competitor PR Monitoring Tools. PR software helps boost your credibility, and nurture brand trust and love. Tools you should have a look at: rogervivieroutlet.ru, Agility PR, Cision, Meltwater, Lexis. Try the leading Public Relations Management software. Start increasing media coverage, save time, track performance & measure ROI from PR. The guide includes tools for: Planning your comms strategy, Creating great PR content, Managing all your news, coverage, and media assets. Respona is the all-in-one PR outreach software that enables brands to connect with relevant journalists and bloggers, in a matter of minutes. PR software helps boost your credibility, and nurture brand trust and love. Tools you should have a look at: rogervivieroutlet.ru, Agility PR, Cision, Meltwater, Lexis.

Muck Rack's PR software serves as an all-in-one relationship management system, streamlining communication and collaboration. Most leading PR software and media monitoring PR tools, including Meltwater, feature in-app dashboards. Interactive dashboards provide a real-time perspective. Public Relations (PR) Software is used by businesses to disseminate important information and events about their company to the public, build their brand. A CRM for PR professionals. Manage contacts, publish newsrooms, pitch journalists and follow-up. All from one straightforward platform. We've curated a list of the best PR tools and software you need. We based this list on the activities of a public relations professional. We've curated a list of the best PR tools and software you need. We based this list on the activities of a public relations professional. Some of the most commonly used PR tools include press releases, news conferences, and publicity. software which includes support for Microsoft Exchange. PR tactics · Audio phone feed · Interview · Media availability · Media briefing · Media centre or press room · Media drop · Media junket · Media participation. The best PR agencies need the best tools. We scoured the internet (and asked some PR pros) to compile this beefy list of the top tools for PR firms. Public relations requires a lot of heavy lifting. From traditional news reporters and bloggers to freelancers, PR professionals must monitor the work of. PR tools are used to manage the entire public relations process. This can include planning, managing, and tracking PR campaigns, conducting PR outreach, and. With our tools, you can measure the success of your PR campaigns through various features, depending on what you're measuring. Our Press Release and Media. 18 examples of public relations tools · 1. Prowly · 2. Meltwater · 3. Prezly · 4. Coverage Book · 5. Cision · 6. Anewstip · 7. Agility PR Solutions · 8. ResponseSource. If you're on the go a lot, or you don't want to shell out a few hundred bucks for office suite software, you can't go wrong with Google Docs. It's web-based. 1. Agility PR Agility is a powerful monitoring and database product. It provides access to more than , reporters, influencers, and content publishers. 5 Best Public Relations Tools to Use · 1. Brand24 · 2. Anewstip · 3. Agility PR Solutions · 4. Brandwatch · 5. HARO. Notified Public Relations solutions help PR professionals optimize brand equity, increase earned media and prove their value. iPR Software provides solutions for PR online news centers and newsrooms, marketing digital assets management (DAM), social media hubs and custom mobile. Prezly - All-in-one Communications Software · Coverage Book - PR reporting tool with automated metrics. Measurement software for Agencies & In-. Prowly is the perfect features-packed tool for marketing and PR professionals. It provides a complete set of tools to efficiently manage.

How To Liquidate 401k Without Penalty

In many cases, you'll have to pay federal and state taxes on your early withdrawal, plus a possible 10% tax penalty. However, taxes will be due on the withdrawal amount in the year taken. Roth IRA withdrawals- Contributions to a Roth IRA can be taken out penalty-free for. Cons: Hardship withdrawals from (k) accounts are generally taxed as ordinary income. Also, a 10% early withdrawal penalty applies on withdrawals before age. Unless you qualify for an exemption, you will also owe a 10% early withdrawal penalty tax on the full amount when you file your taxes. . Alternatives to cash. Here's the great thing about a — no early withdrawal penalty. A deferred compensation retirement plan is much like a (k), but specifically. Typically, with (k) plans, (b) plans, and individual retirement accounts (IRAs), you can start to make penalty-free withdrawals when you turn 59 ½. If you. Early withdrawal of a k is both tax & penalties. Fix your budgeting, withdrawing your retirement to cover for debt is the wrong move unless you have. 1. You could face a high tax bill on early withdrawals Before you retire, your employer's (k) plan may allow you to tap your funds by taking a withdrawal . What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. In many cases, you'll have to pay federal and state taxes on your early withdrawal, plus a possible 10% tax penalty. However, taxes will be due on the withdrawal amount in the year taken. Roth IRA withdrawals- Contributions to a Roth IRA can be taken out penalty-free for. Cons: Hardship withdrawals from (k) accounts are generally taxed as ordinary income. Also, a 10% early withdrawal penalty applies on withdrawals before age. Unless you qualify for an exemption, you will also owe a 10% early withdrawal penalty tax on the full amount when you file your taxes. . Alternatives to cash. Here's the great thing about a — no early withdrawal penalty. A deferred compensation retirement plan is much like a (k), but specifically. Typically, with (k) plans, (b) plans, and individual retirement accounts (IRAs), you can start to make penalty-free withdrawals when you turn 59 ½. If you. Early withdrawal of a k is both tax & penalties. Fix your budgeting, withdrawing your retirement to cover for debt is the wrong move unless you have. 1. You could face a high tax bill on early withdrawals Before you retire, your employer's (k) plan may allow you to tap your funds by taking a withdrawal . What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a.

For this reason, rules restrict you from taking distributions before age 59½. You can take money out before you reach that age. However, an early withdrawal. Withdrawals taken from your (k) account if you are age 59½ or older will not have a penalty. However, a 20% tax on your withdrawal will be withheld if the. While IRAs offer an exception to the early withdrawal penalty for college expenses, early k withdrawals are always subject to a 10% penalty—no exceptions. If you are under 59½ and don't qualify for any of the exceptions to the early withdrawal rules (see "Can I withdraw money from my IRA early without penalty?"). If you are younger than 59 ½, you need to demonstrate that you have an approved financial hardship to get money from your k account without penalty. And. An early withdrawal penalty is assessed when a depositor withdraws funds from or closes out a time deposit before its maturity date. Yes, you can make an early withdrawal – but just because you can, it doesn't mean that you should. Cashing out from your (k) plan early can come with several. If you withdraw from an IRA or (k) before age 59½, you'll be subject to an early withdrawal penalty of 10% and taxed at ordinary income tax rates. · There are. You can request a Plan Hardship by completing and returning the (k) Plan Hardship Withdrawal form (PDF) (PDF). If you have rolled assets into the plan, you. Withdrawals made before age 59 ½ are subject to a 10% early withdrawal penalty and income taxes depending on your tax bracket. However, if you leave your. The IRS allows withdrawals without a penalty for “immediate and heavy financial need” which is subject to interpretation. It's best to consult with the IRS or. Normally, when withdrawing early from a k a 10% penalty is taken from the amount withdrawn as well as income tax. The SECURE act passed. If you turn 55 (or older) during the calendar year you lose or leave your job, you can begin taking distributions from your (k) without paying the early. There's an additional 10% penalty on early withdrawals.3 Your tax bracket is likely to decrease in retirement, which means pulling from your workplace. Also, depending on the type of plan the funds are withdrawn from, you may have a 10% penalty tax as well ( plans are not subject to the 10% early withdrawal. If you withdraw money from your plan before age 59 1/2, you might have a 10% early withdrawal penalty. However, there are exceptions to this early distribution. If you cash out the K, you will owe tax, and if you are under , a 10% penalty. However, the PERSI Choice (k) Plan has various withdrawal options that plan without incurring the 10% early withdrawal tax penalty. For purposes of. If you withdraw money from your (k) account before age 59 1/2, you will need to pay a 10% early withdrawal penalty in addition to income tax on the. How to Avoid Early Withdrawal Penalties. Early withdrawal penalties deduct 10% of the money that you withdraw. When you pair those penalties with your tax.

Should I Get A Line Of Credit

:max_bytes(150000):strip_icc()/how-a-line-of-credit-works-315642-UPDATED-50c98a253c7f42dabfc4111f574dc016.png)

A personal line of credit is a type of financing that you can borrow from over and over again. You must stay within your credit limit. You must be prepared to make this balloon payment by refinancing it with the lender, getting a loan from another lender, or some other means. If you are. Because you can usually get a line of credit at a lower interest rate than your credit card, using a line of credit to pay off credit card debt. While personal lines of credit typically have higher interest rates than personal loans, secured lines of credit tend to have lower interest rates than. With a line of credit, there may be additional costs, such as origination or transaction fees. You should review any rates and fees associated with a line of. With a line of credit, you can access the funds at any time and enjoy a lower interest rate than most credit cards. It's great for when you need money fast. loans typically have lower interest rates than other kinds of loans. Cover emergency expenses. If you've used up the cash in your emergency fund, you could. A line of credit gives you ongoing access to funds that you can use and re-use as needed. You're charged interest only on the amount you use. "A business line of credit can be crucial to help a business take advantage of an opportunity or weather a crisis," says Gerri Detweiler, former education. A personal line of credit is a type of financing that you can borrow from over and over again. You must stay within your credit limit. You must be prepared to make this balloon payment by refinancing it with the lender, getting a loan from another lender, or some other means. If you are. Because you can usually get a line of credit at a lower interest rate than your credit card, using a line of credit to pay off credit card debt. While personal lines of credit typically have higher interest rates than personal loans, secured lines of credit tend to have lower interest rates than. With a line of credit, there may be additional costs, such as origination or transaction fees. You should review any rates and fees associated with a line of. With a line of credit, you can access the funds at any time and enjoy a lower interest rate than most credit cards. It's great for when you need money fast. loans typically have lower interest rates than other kinds of loans. Cover emergency expenses. If you've used up the cash in your emergency fund, you could. A line of credit gives you ongoing access to funds that you can use and re-use as needed. You're charged interest only on the amount you use. "A business line of credit can be crucial to help a business take advantage of an opportunity or weather a crisis," says Gerri Detweiler, former education.

What can I use a line of credit for? · Home improvements. Did your plans for some new appliances turn into a whole new kitchen? · Emergency fund. The unexpected. On the plus side, lines of credit typically have a lower interest rate compared to credit cards or personal loans. Furthermore, you may not be charged set-up. Why should you choose a line of credit? · It helps cash flow. A line of credit allows you to get the cash you need when you need it. · You pay only for your use. After getting approved for a line of credit, it's up to you to determine how and when you use it. You could just as easily take the full amount on day one as. Credit lines tend to have higher interest rates than loans. Interest accrues on the full loan amount right away. Interest accrues only when funds are accessed. could get for your home if you sold it. High interest rates, financing fees, and other closing costs and credit costs can also make it very expensive to. As with a personal loan, you will get the full loan amount all at once so you must begin paying down the entire loan. A home equity loan also includes costs of. By contrast, personal loans typically have lower interest rates, which can make them better for longer-term and more expensive needs, such as buying a car. With a fixed interest rate, you won't have to worry about the variable interest rate that comes with opening a line of credit, which could make paying back the. As with a personal loan, you will get the full loan amount all at once so you must begin paying down the entire loan. A home equity loan also includes costs of. A personal line of credit can be a valuable financial tool to help you pay for unexpected expenses or to cover gaps in regular monthly income. With a fixed interest rate, you won't have to worry about the variable interest rate that comes with opening a line of credit, which could make paying back the. If you're looking for a more flexible way to borrow money, then a line of credit is the way to go. That said, you do have to do some research and find the right. A personal line of credit is a type of financing that you can borrow from over and over again. You must stay within your credit limit. To qualify for a HELOC, you need to have available equity in your home, meaning that the amount you owe on your home must be less than the value of your home. Whether you should get a personal loan or a credit card depends on how you want to use the money you borrow. Credit cards are best used for daily expenses. should be less than 43% of your total monthly income. To prove you You need to have fairly good credit in order to qualify for most home equity loans. A line of credit gives you access to money that you can use and repay as you need to over a certain time frame. You'll know you have the money available should. "A business line of credit can be crucial to help a business take advantage of an opportunity or weather a crisis," says Gerri Detweiler, former education.

Define Gross Profit

Gross profit is the direct profit left over after deducting the cost of goods sold, or cost of sales, from sales revenue. It's used to calculate the gross. The gross profit margin is the ratio of gross profit to net revenue, expressed as a percentage. The gross profit is equal to net revenue minus the cost of. The gross profit meaning is the profit a company makes after deducting the costs associated with making and selling its products or services. Gross margin is the percentage of a company's revenue that it keeps after subtracting direct expenses such as labor and materials. You are a baker. · Your gross margin is calculated as a percentage of how much your sales revenue exceeds the total cost of making the sale. · The short answer? gross profit in Retail A company's gross profit is the difference between its total income from sales and its total production costs. Gross profit is the. Gross profit is the amount a company has remaining after deducting costs related to manufacturing and selling of products and services. In short, gross profit is your revenue without subtracting your manufacturing or production expenses, while net profit is your gross profit minus the cost of. Gross profit is the money you have left after paying for the things you sold to customers. Gross profit is the direct profit left over after deducting the cost of goods sold, or cost of sales, from sales revenue. It's used to calculate the gross. The gross profit margin is the ratio of gross profit to net revenue, expressed as a percentage. The gross profit is equal to net revenue minus the cost of. The gross profit meaning is the profit a company makes after deducting the costs associated with making and selling its products or services. Gross margin is the percentage of a company's revenue that it keeps after subtracting direct expenses such as labor and materials. You are a baker. · Your gross margin is calculated as a percentage of how much your sales revenue exceeds the total cost of making the sale. · The short answer? gross profit in Retail A company's gross profit is the difference between its total income from sales and its total production costs. Gross profit is the. Gross profit is the amount a company has remaining after deducting costs related to manufacturing and selling of products and services. In short, gross profit is your revenue without subtracting your manufacturing or production expenses, while net profit is your gross profit minus the cost of. Gross profit is the money you have left after paying for the things you sold to customers.

Gross profit is a company's total sales after deducting the costs associated with selling its products and/or services. More In File Adjusted gross income, also known as (AGI), is defined as total income minus deductions, or "adjustments" to income that you are eligible to take. It's a financial indicator highlighting the difference between a company's total revenue and the cost of goods sold (COGS). What is Gross Profit? Gross profit, also sometimes termed gross sales, is the money left over after deducting the cost of goods sold (COGS) from revenue. In. Gross profit is the difference between your net sales and your costs of sales. Learn how it measures your company's financial efficiency and profitability. gross profit (gross margin; gross profit margin) The difference between the sales revenue of a business and the *cost of sales. It does not include the costs. What is gross profit? Gross profit on a product is the selling price of your product minus the cost of producing it. For a service business, it's the selling. Gross profit is determined by deducting the cost of goods sold (COGS) from business income. Get the complete gross profit definition here. Gross profit is a business's income from sales minus those of its day-to-day outgoings that relate directly to making sales. These outgoings are sometimes. Gross profit is the profit a company makes after deducting the direct costs associated with providing a product or service. For households and individuals, gross income is the sum of all wages, salaries, profits, interest payments, rents, and other forms of earnings. Gross profit takes all income and total cost of goods sold/revenue into account, while net profit measures all income and expenses of a business. That means. Gross Profit Example. Suppose company A has a total revenue number of $50, The costs associated with producing its products are: To get the COGS total. What is gross profit? Gross profit is the profit you make by selling your goods or services, after deducting the cost of goods sold. Cost of goods sold (GOGS). What is a good gross profit margin ratio? On the face of it, a gross profit margin ratio of 50 to 70% would be considered healthy, and it would be for many. Gross margin and Gross profit are two related metrics that are critical for understanding your business. What is gross profit percentage? It's a financial measurement that shows the percentage of revenue that exceeds the cost of goods sold (COGS). It is calculated. Gross profit measures the difference between revenue and cost of goods sold (COGS) and is considered one of the best measures of business profitability. GROSS PROFIT definition: a company's profit from selling goods or services before costs not directly related to producing. Learn more.

Social Media Stream

15 Social Networks To Stream – 15 Social networks including Twitter, Facebook, YouTube, Vimeo, Flickr, Instagram, Pinterest, Tumblr, Dribbble, Foursquare. Marketing specialists who need to support live video in the same manner as social media. LET'S EXPLORE SWITCHBOARD. Multistreaming, made simple! With. BEST SELLER». Showcase your posts from Facebook, Twitter, Instagram Youtube, Pinterest and Tumblr onto one stunning social widget. The Stream + is everything you need to become a streamer: A microphone; a Phone Camera Holder Clamp; a 3-mode Ring Light; a Bluetooth Selfie Clicker; and a. Spaceback's platform instantly converts your social media videos from Instagram, TikTok, Facebook, X (Twitter), and Pinterest into online video ready dynamic. Facebook is a great place for potential customers to find information about your business. Feeds stream posts (including video and photos) from your Facebook. Joomla Social Stream displays Facebook feed, Twitter, Instagram, Youtube, Pinterest, Flickr, Vimeo, SoundCloud, VK, RSS on your site easily. Description. Flow-Flow — WordPress Facebook Instagram Twitter Feed Grid Gallery is a multipurpose social media wall plugin that allows to display a mix of. Searching for Social Streaming Apps or Wordpress Social Stream Plugin? Combine your entire social network & create amazing social media walls. 15 Social Networks To Stream – 15 Social networks including Twitter, Facebook, YouTube, Vimeo, Flickr, Instagram, Pinterest, Tumblr, Dribbble, Foursquare. Marketing specialists who need to support live video in the same manner as social media. LET'S EXPLORE SWITCHBOARD. Multistreaming, made simple! With. BEST SELLER». Showcase your posts from Facebook, Twitter, Instagram Youtube, Pinterest and Tumblr onto one stunning social widget. The Stream + is everything you need to become a streamer: A microphone; a Phone Camera Holder Clamp; a 3-mode Ring Light; a Bluetooth Selfie Clicker; and a. Spaceback's platform instantly converts your social media videos from Instagram, TikTok, Facebook, X (Twitter), and Pinterest into online video ready dynamic. Facebook is a great place for potential customers to find information about your business. Feeds stream posts (including video and photos) from your Facebook. Joomla Social Stream displays Facebook feed, Twitter, Instagram, Youtube, Pinterest, Flickr, Vimeo, SoundCloud, VK, RSS on your site easily. Description. Flow-Flow — WordPress Facebook Instagram Twitter Feed Grid Gallery is a multipurpose social media wall plugin that allows to display a mix of. Searching for Social Streaming Apps or Wordpress Social Stream Plugin? Combine your entire social network & create amazing social media walls.

During live streams, videos become conversation as opposed to just broadcasting. In live streams, a brand can engage with audiences who can. Social Media Stream is dé applicatie voor het integreren van jouw social media berichten in je website. Deel jouw social media posts online in één stream. Some social media platforms, such as Facebook, YouTube and LinkedIn, also offer occasional live streaming events. Users can watch a livestream on any compatible. Bambuser's Social Media Multistream feature allows clients to go live on multiple platforms at once. The feature enables multistreaming of live-video content. A social media stream is a feed of content collected from multiple platforms and displayed on a marketing channel such as digital signage, or most commonly a. stream beautifully across streaming TV platforms. We use it to broadcast our weekly Social Media Marketing Talk Show across YouTube, Facebook, and LinkedIn. It doesn't take much to help spread the word about the important work of MAF. Just follow the stream to stories from MAF's global media feed. Discover how you can Embed Instagram Feed WordPress Website? Social Media Stream by Flow-Flow is also available on Shopify & Standalone. Try it now! social media platform/s concerned (e.g. Facebook, Twitter, Instagram, etc); website or webpage where your Social Stream is embedded; email address associated. social media complaints. Whether your content is in the media, entertainment, telecom, or sports sector, Cognizant Video Insights lets you act. Social media live streaming is one of the best ways to engage followers. And you don't need any special equipment to get started. Social Media Streaming · Looking for an easy way to stream your video to platforms such as YouTube, Facebook or Twitch? Facebook is a great place for potential customers to find information about your business. Feeds stream posts (including video and photos) from your Facebook. About STREAM As part of UC Davis' Strategic Communications Social Media team, STREAM is a cohort of students who assist with creating, developing, editing. Streaming media refers to multimedia for playback using an offline or online media player that is delivered through a network. Media is transferred in a. Social Stream Ninja · Supports live automated two-way chat messaging with Facebook, Youtube, Twitch, Zoom, and dozens more · Includes a "featured chat" overlay. Live streaming allows you to reach more users on social media, just like radio and television did for society before social media. Live social media stream on digital signage It is now possible to display a “live” social media stream on the digital signage across campus. The stream is. Stream makes it easy to build scalable social networks, news feeds and activity streams with your favorite programming language. Users should fully review and understand the UT Tyler Social Media Guidelines and Social Media Policy. Social Media Stream · Plan Your Visit. Back; Cowan.

How To Buy Land On Sandbox

You can buy The Sandbox in small or large quantities. Start by purchasing The Sandbox for as little as $30 on MoonPay. security ISO certified. MoonPay. Buying land on Sandbox is also a popular NFT utility idea to attract investors. In addition, you can also host contests and giveaways through different. A Wallet is required to purchase a Land. To make the purchase you will need to be connected with your Wallet and have it supplied with Ethereum (ETH). After. This digital piece of real estate can be used for anything. Once a user owns LAND, they can populate it with ASSETs and games. Landowners are also permitted to. To purchase LAND from The Sandbox, you need to have registered an account first. - How to register an account at The Sandbox | The Sandbox. The record for the most expensive land sale in the metaverse has just been raised with the purchase of roughly $ million worth of land on The Sandbox. From the Marketplace: · Go to the Marketplace: Navigate to the Marketplace. · Go to the LAND & ESTATES section (you can use the filter to easily. The Sandbox metaverse comprises a map made up of , LANDS. LAND owners can host contests and events, stake SAND to earn and customize assets, monetize. As a player, you need SAND in order to upgrade your avatar, play games, or join certain events and experiences. Meanwhile, creators spend SAND to buy LAND, and. You can buy The Sandbox in small or large quantities. Start by purchasing The Sandbox for as little as $30 on MoonPay. security ISO certified. MoonPay. Buying land on Sandbox is also a popular NFT utility idea to attract investors. In addition, you can also host contests and giveaways through different. A Wallet is required to purchase a Land. To make the purchase you will need to be connected with your Wallet and have it supplied with Ethereum (ETH). After. This digital piece of real estate can be used for anything. Once a user owns LAND, they can populate it with ASSETs and games. Landowners are also permitted to. To purchase LAND from The Sandbox, you need to have registered an account first. - How to register an account at The Sandbox | The Sandbox. The record for the most expensive land sale in the metaverse has just been raised with the purchase of roughly $ million worth of land on The Sandbox. From the Marketplace: · Go to the Marketplace: Navigate to the Marketplace. · Go to the LAND & ESTATES section (you can use the filter to easily. The Sandbox metaverse comprises a map made up of , LANDS. LAND owners can host contests and events, stake SAND to earn and customize assets, monetize. As a player, you need SAND in order to upgrade your avatar, play games, or join certain events and experiences. Meanwhile, creators spend SAND to buy LAND, and.

#SANDBOX1 Timeline Snoop Dogg announces his acquisition of “land in the blockchain-based virtual metaverse The Sandbox.” The Sandbox holds a “Snoopverse. Basically, LANDs are virtual pieces of NFT real estate in The Sandbox. Owners can flex their creative juice in countless ways to monetize their property, rent. In addition to voxel NFTs and SAND tokens, The Sandbox also allows users to purchase the actual land that makes up its shared virtual world. The. A LAND is a digital piece of real estate in The Sandbox metaverse that players can buy to build experiences on top of. Once you own a LAND, you will be able. Metaverse Properties offers land in premium locations in Sandbox for individuals, enterprises and institutions. You'll find our land in Sandbox below that. Bro if you are still looking to buy LAND in Sandbox Game you should definitely check out Land Detector on Twitter. They select undervalued LAND. Use SAND to buy Property in Sandbox. You can use SAND to buy digital plots of land in Sandbox. Buy SAND as an investment. As the Sandbox ecosystem grows and. If you've chosen Sandbox as your marketplace and have already created a digital crypto wallet, go ahead and link the wallet to Open Sea which is the main. The Sandbox consists of , plots of land that are available for purchase at a minimum of ETH which is about $ · The Sandbox has a governance token. Yes, offcourse it is, but agricultural land is considered a good investment for high net-worth individuals and for those with surplus income. To buy The Sandbox LAND, you can either use its The Sandbox Map that allows users to buy LAND assets during public sales. You can also buy LAND on secondary. A LAND is a digital piece of real estate in The Sandbox metaverse that players can buy to build experiences on top of. Once you own a LAND, you will be able. You can buy the land from either sandbox marketplace or opensea/rarible. Make sure the link is correct and cross check that u are buying the. For example, if you want to buy land in Sandbox, you'll need to use the native crypto for Sandbox. So, you can use the $SAND currency to buy land in that. Discover, sell and buy NFTs on Rarible! Our aggregated NFT marketplace Sandbox's LANDs. Royalties0%. Floor. —. Volume. K ETH. Items. K. Owners. Are you familiar with how to buy LAND? rogervivieroutlet.ru And what you can do with it? rogervivieroutlet.ru 2️⃣ hours to go. Decentraland and the Sandbox, two of the largest metaverse platforms, used to charge less than $1, for the smallest plots of land available for purchase. LAND is a digital real estate portion of the Sandbox ecosystem. The user can buy a LAND by learning about the Sandbox Metaverse's entire landscape. If you are. #SANDBOX1 Timeline Snoop Dogg announces his acquisition of “land in the blockchain-based virtual metaverse The Sandbox.” The Sandbox holds a “Snoopverse. Factors to consider before buying a virtual land · Choose a reputed marketplace to buy your virtual land – Use a reputed NFT marketplace like.

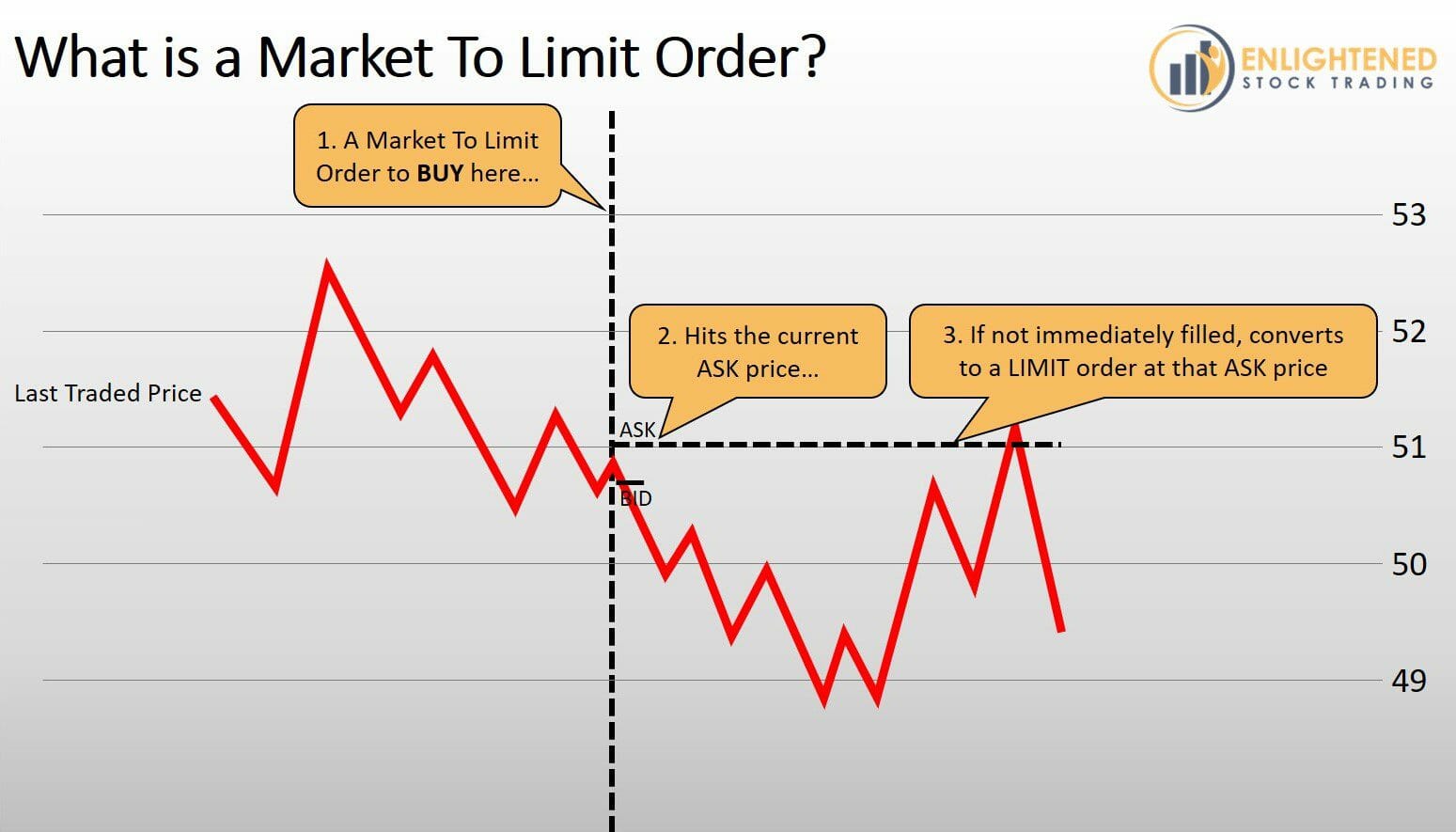

Stock Trading Limit Order

The order will only execute at or below your $13 limit. You own a stock that's trading at $12 a share. You'll sell if the price rises to $13, so you place a. Limit orders are a way to enter the market at a preselected price. Find out what you need to know about limit orders in trading. Risk management. A stop order initiates a market order, which tells your broker to buy or sell at the best available market price once the order is processed. Trading price is of less concern to them. Limit orders are favored by traders who focus more on short-term price trends in stocks, and who buy and sell. It is very important for a trader to get the best price possible while placing an order in the stock market. · So, for managing the stock market trades, various. Can I place a limit, stop, or stop-limit order for a mutual fund? You cannot place a limit, stop, or stop-limit order for a mutual fund. Mutual fund orders must. Sell stop order: This type of order can help limit your losses if a stock you own falls more than you'd like. When triggered, the order becomes a market order. Following the activation of the stop price, the limit order dictates the price that the trade will be executed, whether that be buying or selling a stock. The. When you're trading stocks, it's important to understand that a limit order allows you to specify the maximum price you're willing to pay or the minimum price. The order will only execute at or below your $13 limit. You own a stock that's trading at $12 a share. You'll sell if the price rises to $13, so you place a. Limit orders are a way to enter the market at a preselected price. Find out what you need to know about limit orders in trading. Risk management. A stop order initiates a market order, which tells your broker to buy or sell at the best available market price once the order is processed. Trading price is of less concern to them. Limit orders are favored by traders who focus more on short-term price trends in stocks, and who buy and sell. It is very important for a trader to get the best price possible while placing an order in the stock market. · So, for managing the stock market trades, various. Can I place a limit, stop, or stop-limit order for a mutual fund? You cannot place a limit, stop, or stop-limit order for a mutual fund. Mutual fund orders must. Sell stop order: This type of order can help limit your losses if a stock you own falls more than you'd like. When triggered, the order becomes a market order. Following the activation of the stop price, the limit order dictates the price that the trade will be executed, whether that be buying or selling a stock. The. When you're trading stocks, it's important to understand that a limit order allows you to specify the maximum price you're willing to pay or the minimum price.

Stop orders can be deployed as stop-loss or stop-limit orders. A stop-loss order triggers a market order when a designated price is hit, whereas a stop-limit. A Limit order is an order to buy or sell at a specified price or better. The Limit order ensures that if the order fills, it will not fill at a price less. If you want to protect the price for your ETF trade, use a limit order—even if the ETF is highly liquid. Yes, submitting a limit order may take a few seconds. A limit order is not guaranteed to execute. A limit order can only be filled if the stock's market price reaches the limit price. While limit orders do not. The most common types of orders are market orders, limit orders, and stop-loss orders. A market order is an order to buy or sell a security immediately. Although the word 'limit' is not there, it's assumed to be a limit order if a price is specified and nothing else. This is a sell limit order, where the. When you should choose a market vs limit order depends on your priorities. If you absolutely want the trade to go through and the final price is less important. A market order is the most basic type of stock trade. It is simply an order to buy or sell a stock at a price determined once the trade executes. The order will. If you want to protect the price for your ETF trade, use a limit order—even if the ETF is highly liquid. Yes, submitting a limit order may take a few seconds. A limit order is an order to buy or sell a security at a specific price. A buy limit order can only be executed at the limit price or lower, and a sell. What is a limit order? When you place a limit order to buy, the stock is eligible to be purchased at or below your limit price, but never above it. You may. A limit order is an instruction you give to buy or sell an asset at a specific price. . The instruction is usually given to a broker that will automatically. Limit orders are types of stock trades that let you buy or sell at a set price. Limit buy orders set the most youre willing to pay for a stock. Limit sell. A limit order might be used when you want to buy or sell at a specific price. If you are concerned about risks to the market, one action you can take is to. A stop-limit order is a tool that traders use to mitigate trade risks by specifying the highest or lowest price of stocks they are willing to. A buy order can match at the limit price or lower, and a sell order can match at the limit price or higher. Market Order An order to buy or sell without. Browse Terms By Number or Letter: An order to buy a stock at or below a specified price, or to sell a stock at or above a specified price. For instance, you. The investor can submit a market order or set a limit order. A limit order is a request to buy or sell a security at a specified price. If the stock doesn't. A limit order is a tool which gives investors more control about their trades. You can use it to purchase or sell stocks or other securities at a specific.

Top Games Pay Real Money

Solitaire Cash invites players to compete in Solitaire games online and win real cash prizes. Best of all, it offers free entry into its. Top paid games · Minecraft: Java & Bedrock Edition for PC. Included with Game PassOffers in app purchases · Minecraft: Java & Bedrock Edition. #2: The Best & Real Money Earning Games that Cash Out to Paypal? top 3: "Thrillz - Win Cash" on IOS. "Relxxx" on IOS. "Pocetsevengame. The Silicon Review 21 December, Mobile games are hugely popular among · Blackout Bingo. For Australian bingo fans, Blackout Bingo offers a new and. When it comes to online betting games real money, Roulette stands out as a popular choice. It is a classic casino game that involves a spinning wheel with. Win Real Money Online with Game Champions | The #1 Social Gaming Platform with Free Tournaments, Skill Gaming Competitions and Instant withdrawals. Bubble Cash; Mistplay; 8 Ball Strike; Swagbucks; Rewarded Play; Cash'em All; Pool Payday; AppStation; InboxDollars; Fruit Frenzy; Solitaire Cash; Solitaire for. Swagbucks is perhaps the web's no. 1 venue for taking surveys, watching videos, and playing games for cash online. The platform is well-built, well-reviewed. 25 Top apps that pay $ a day in ; Mistplay, Android, Earn real money by playing various games. Make $3 to $5 per hour. ; Dominoes Gold, Android & iOS. Solitaire Cash invites players to compete in Solitaire games online and win real cash prizes. Best of all, it offers free entry into its. Top paid games · Minecraft: Java & Bedrock Edition for PC. Included with Game PassOffers in app purchases · Minecraft: Java & Bedrock Edition. #2: The Best & Real Money Earning Games that Cash Out to Paypal? top 3: "Thrillz - Win Cash" on IOS. "Relxxx" on IOS. "Pocetsevengame. The Silicon Review 21 December, Mobile games are hugely popular among · Blackout Bingo. For Australian bingo fans, Blackout Bingo offers a new and. When it comes to online betting games real money, Roulette stands out as a popular choice. It is a classic casino game that involves a spinning wheel with. Win Real Money Online with Game Champions | The #1 Social Gaming Platform with Free Tournaments, Skill Gaming Competitions and Instant withdrawals. Bubble Cash; Mistplay; 8 Ball Strike; Swagbucks; Rewarded Play; Cash'em All; Pool Payday; AppStation; InboxDollars; Fruit Frenzy; Solitaire Cash; Solitaire for. Swagbucks is perhaps the web's no. 1 venue for taking surveys, watching videos, and playing games for cash online. The platform is well-built, well-reviewed. 25 Top apps that pay $ a day in ; Mistplay, Android, Earn real money by playing various games. Make $3 to $5 per hour. ; Dominoes Gold, Android & iOS.

What game apps pay real money instantly? · MyKONAMI. This is a slots/Vegas-style game available for iOS only. · Blackout Blitz. Also available only for iOS, this. Solitaire Cash: Best Solitaire Money Game. Solitaire Cash. App Store Rating: stars out of 5 with over , ratings. How The Game. Top casino games for real money gaming ; Craps. From % ; Slots. From % ; Poker. From % ; Roulette. From % ; Sic bo. From %. How to get paid to play video games · Play games to earn money on Swagbucks · Play games to earn money on Freecash · Play games to earn money on Mistplay · Become a. Top 9 Best Game Apps That Pay Real Money · 9. Solitaire Journey: Solitaire Venture · 8. Underwater Bingo Adventure: Bingo Bliss · 7. Play Pool Online: Cash Pool. 1. Blackout Bingo: Best Money-Making Game Overall. Are you ready to take your Bubble Shooter skills to the next level and get a chance to win real money? Bubble Cash® is the top classic bubble shooter game for. Go “Discover” and then to games and search for the kind of game that you enjoy playing. You can search by most popular, alphabetically, or by the amount of SB. It's like having the best of both worlds – enjoying your favorite games that pay real money while also gaining personal growth and financial rewards. With. Step into the lucky world of Match to Win, where thrilling tournaments are your gateway to earn fantastic rewards! Engage in match-3 puzzles and lotto-style. Best Game Apps To Win Real Money · 1. KashKick · 2. Swagbucks · 3. InboxDollars · 4. Freecash · 5. MyPoints · 6. Blackout Bingo · 7. Bingo Cash · 8. Solitaire. Swagbucks: While primarily a survey site, Swagbucks also offers paid games. You can earn points and convert them to cash, which you can transfer to the Cash App. 1- Klondike Solitaire: This is one of the most well-known cash rewards offering solitaire earning games. It involves dealing cards into several tableau piles. 10 Best Games That Pay Real Money in ; Brain Battle, Puzzle Game, ; Spades Card Game, Card Game, ; Givling, Trivia Game, ; Lucktastic, Scratch. Match To Win: Real Money Games 17+. Rewarded Play! Real Cash Games I don't know how to best convince that I'm a real human person because if I. Play video games for money - Madden, FIFA, NBA2K, NHL, COD, Fortnite & more. Compete in online tournaments on XBox, PS5, Mobile & PC. Top Games Awarding Prize Money ; #1. Dota 2. $,, Players Tournaments ; #2. Fortnite. $,, Players Tournaments ; #3. Top 'get paid to play' apps & websites · Mistplay – Android only, huge range of games. Call Break is one of the most popular real card games online. If you've got great casual gaming skills and have mastered the art of card tricks, Call Break is.