rogervivieroutlet.ru

Learn

House Insurance Cost Estimator

GEICO's Personal Property Calculator is easy to use and can help place a value on your belongings to choose the right personal property insurance coverage. The national average for condo insurance is $ a year. This was for a policy with $60, in personal property coverage, $, in liability protection and. Answer a few simple questions with our home insurance calculator and we'll suggest customized homeowners insurance coverage options that might be a good fit. You can use the cost it gives you to assist in setting the Sum Insured on your house insurance. If your home is insured for its replacement value (Maxi policy. These calculators provide home valuation methods very similar to what insurance companies use when calculating the value of a home they insure. Did you know that the average home insurance claim is around $16,? If your house were to catch on fire and burn down, would you be able to cover that cost. MoneyGeek's home insurance calculator will give you a ballpark estimate of your cost — it's free, no personal information required, no spam. A home insurance calculator is a convenient tool that allows you to estimate your monthly insurance costs without having to provide any personal information. There are many factors that influence homeowners insurance rates. Use our home insurance calculator to help determine your coverage and estimated costs. GEICO's Personal Property Calculator is easy to use and can help place a value on your belongings to choose the right personal property insurance coverage. The national average for condo insurance is $ a year. This was for a policy with $60, in personal property coverage, $, in liability protection and. Answer a few simple questions with our home insurance calculator and we'll suggest customized homeowners insurance coverage options that might be a good fit. You can use the cost it gives you to assist in setting the Sum Insured on your house insurance. If your home is insured for its replacement value (Maxi policy. These calculators provide home valuation methods very similar to what insurance companies use when calculating the value of a home they insure. Did you know that the average home insurance claim is around $16,? If your house were to catch on fire and burn down, would you be able to cover that cost. MoneyGeek's home insurance calculator will give you a ballpark estimate of your cost — it's free, no personal information required, no spam. A home insurance calculator is a convenient tool that allows you to estimate your monthly insurance costs without having to provide any personal information. There are many factors that influence homeowners insurance rates. Use our home insurance calculator to help determine your coverage and estimated costs.

The cost of home insurance can vary depending on several factors including but not limited to: Amount of dwelling coverage. Age of. How much dwelling coverage do I need? · To estimate the cost of rebuilding: · How much personal property coverage do I need? · How much liability coverage do I. A home insurance calculator is an online tool that lets homeowners check the premium for a particular home insurance plan. Several elements contribute to the cost of your home insurance premiums. Everything from ZIP code to property value may have an impact on what you pay each. A home insurance calculator can help you to compare home insurance quotes quickly and find out what average rates are for homes like yours. It should be an invariable practice of an agency to insure structures for percent of the estimated replacement cost. Doing that, however, is NOT THE SAME. How much does homeowners insurance cost? The To qualify for this coverage, dwelling must be insured for a minimum of 95% of estimated rebuild cost. Calculate home replacement cost by multiplying your area's average per-foot rebuilding cost by your home's square footage (or use our easy calculator). The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from $ ($83/month) to $ ($/month). Online: Many insurance companies offer online quote tools where you answer questions about your home and belongings. Phone: ; Property details: Address, year. So, aim to purchase an amount of coverage at least equal to the estimated replacement cost. Get a homeowners insurance quote. ZIP Code. Simple to use, our home insurance calculator can help determine these values. We make it easy to see what your home value should be on your home insurance. How do I know how much dwelling coverage I need? · Why we need your ZIP code. Our calculator uses the average building cost in your area to determine how much it. Generally, the formula takes into account the 80/20 percent rule. An insurance company will only cover the cost of damage to a house or property if the. However, you can use the below home insurance cost estimator to get a strong idea about the amount of coverage and deductible you may need. The average property. Home insurance estimates from your local city and state. Enter your home value and zip code for a free estimate. Average US home insurance rate in is. Home > Insurance Policies > Premium Calculator. Get Your California Use CEA's Premium Calculator to estimate the cost of a CEA California residential. Web calculators that reference current building and replacement costs play an important part in helping you decide the sum-insured. Home insurance estimates from your local city and state. Enter your home value and zip code for a free estimate. Average US home insurance rate in is. The average annual homeowners insurance premium runs about $1, However, it can be much higher or lower based on numerous factors. Here's a full rundown of.

Best Funds To Invest In During A Recession

High-quality stocks: Companies with low debt, positive earnings, strong cash flow, and low volatility tend to outperform when recessions hit and investors turn. That could mean more opportunities for actively managed bond mutual funds and ETFs, and also continued potential opportunities for those seeking attractive. Best Investments to Recession-Proof Your Investment Portfolio · 1. Commodities · 2. Pharmaceuticals · 3. Technology Startups · 4. Grocery Stores · 5. Utility Stocks. These deep cuts can impair their productivity and ability to fund new investments. Leverage effectively limits companies' options, forcing their hand and. Unlike deposits at a credit union or bank, most investments in stocks are not insured and you can lose some or all of your investment if prices fall after you. Best-day investments (Market lows). Date of market low. Cumulative investment. Total value. 8/12/ $10, $11, 4/20/ 20, 23, 6/13/ Surviving a recession: the best funds to invest in during an economic turmoil · Hedge Funds. Hedge funds are a good choice if you desire higher risk with a. What happens to my investments during a recession? Investing isn't a game we best of you when it comes to your investments. Legal. 1https://www. The sharp declines in stock prices that occur during a crisis or recession may present good opportunities to invest. Some companies may be undervalued by the. High-quality stocks: Companies with low debt, positive earnings, strong cash flow, and low volatility tend to outperform when recessions hit and investors turn. That could mean more opportunities for actively managed bond mutual funds and ETFs, and also continued potential opportunities for those seeking attractive. Best Investments to Recession-Proof Your Investment Portfolio · 1. Commodities · 2. Pharmaceuticals · 3. Technology Startups · 4. Grocery Stores · 5. Utility Stocks. These deep cuts can impair their productivity and ability to fund new investments. Leverage effectively limits companies' options, forcing their hand and. Unlike deposits at a credit union or bank, most investments in stocks are not insured and you can lose some or all of your investment if prices fall after you. Best-day investments (Market lows). Date of market low. Cumulative investment. Total value. 8/12/ $10, $11, 4/20/ 20, 23, 6/13/ Surviving a recession: the best funds to invest in during an economic turmoil · Hedge Funds. Hedge funds are a good choice if you desire higher risk with a. What happens to my investments during a recession? Investing isn't a game we best of you when it comes to your investments. Legal. 1https://www. The sharp declines in stock prices that occur during a crisis or recession may present good opportunities to invest. Some companies may be undervalued by the.

Economic downturns do not last forever, and if history is a guide, a good way to avoid losses in a recession is to take a long-term approach and ignore the. Which Bonds Perform Best In A Recession? · 1. US Treasury Bond/ Federal Bonds · 2. Municipal Bonds and TIPS · 3. Taxable Corporate Bonds. From mutual funds and ETFs to stocks and bonds, find all You should consider whether you would be willing to continue investing during a long downturn. The housing sector led not only the financial crisis, but also the downturn in broader economic activity. Residential investment peaked in , as did. going into the recession: sell equities and corporate bonds, buy intermediate treasuries. In the middle of the recession, buy high yield bonds. Overall, most would agree that commodity based investments are the best asset to hold during a recession. These are ETFs, stocks, mutual funds or other. As noted above, student housing is another great investment to make during a recession, particularly student housing in primary markets near the nation's top. If you're already in the stock market, look to expand and add high dividend stocks like mutual funds and exchange-traded funds (EFTS) that invest in consumer. What Should You Invest in During a Recession? Real estate is arguably the best asset to invest in during a recession. But, it's important to understand that. Investing in essentials like utilities is a classic lower-risk investment. Even during a recession, there will always be a need for the service utilities offer. High-Yield Savings Account A high-yield savings account might not be the best long-term investment for your money, but it can be a great place to ride out. 1. Stocks and bonds have historically experienced gains before a recession begins · 2. Not all recessions are the same · 3. Investing during a recession isn't. A fund that invests in this manner is Vanguard LifeStrategy 60% Equity. It provides 60% exposure to global equities and 40% exposure to global bonds via several. From mutual funds and ETFs to stocks and bonds, find all You should consider whether you would be willing to continue investing during a long downturn. The best way to get through a recession is by having a diversified portfolio – one of the hallmarks of wise investing in any economic cycle. A diversified. REITs are a popular asset class to invest in during a recession. Because people still need a place to live and work regardless of the broader economy, REITs are. The best investment method is a steady one. On any given day, you may have positive or negative returns. But over long periods, the markets tend to go up. Also. If anything, a market downturn is a good time to buy stocks cheaply. For those who want to take advantage but have low risk, Kendall recommends a dollar-cost. Our thought leaders share timely insights and observations on matters relevant to investors, the investment industry, and the world's financial markets and. A list of the top companies in which the fund is invested and the percentage choices during inevitable periods of high market volatility. Will you.

Top Water Conditioners

A water softener that uses salt to remove hardening minerals or a salt-free water conditioner that neutralizes these minerals? It is a hard decision. Aquarium Water Care & Conditioner · Top Fin Pre-Conditioned Aquarium Water · API Stress Coat Tap Water Aquarium Conditioner · Seachem Prime Aquarium Water. Water conditioners that use TAC media do not require electricity. These systems passively alter the physical structure of the minerals in your water. This means. Explore the dissimilarity between water conditioners and water softeners. Discover which one suits your needs best. Visit Rayne Water Solutions' blog. Conditioners ; 1, A+, Aquasana - Salt-Free Water Conditioner - WH-SFWC-S · $ ; 2, A, WaterBoss® - Whole House Water Descaler - WH-WB-DSCLR · $ ; 3, B. One leading electronic water conditioner is so effective at generating nucleation seeds and reducing the dissolved calcium it has been proven to result in. Sponsored Products · Rheem. 32, Grain Preferred Home Water Softener for Hard Water and Iron Reduction · PENTAIR. Water Softener System for 5 to 6 Bathrooms. To take the first step toward deciding on the best water softener for your needs, you can schedule a home water test today. Kenmore Water Softener With High Flow Valve | Reduce Hardness Minerals & Clear Water Iron In Your Home | Whole House | Easy To Install | Grey. A water softener that uses salt to remove hardening minerals or a salt-free water conditioner that neutralizes these minerals? It is a hard decision. Aquarium Water Care & Conditioner · Top Fin Pre-Conditioned Aquarium Water · API Stress Coat Tap Water Aquarium Conditioner · Seachem Prime Aquarium Water. Water conditioners that use TAC media do not require electricity. These systems passively alter the physical structure of the minerals in your water. This means. Explore the dissimilarity between water conditioners and water softeners. Discover which one suits your needs best. Visit Rayne Water Solutions' blog. Conditioners ; 1, A+, Aquasana - Salt-Free Water Conditioner - WH-SFWC-S · $ ; 2, A, WaterBoss® - Whole House Water Descaler - WH-WB-DSCLR · $ ; 3, B. One leading electronic water conditioner is so effective at generating nucleation seeds and reducing the dissolved calcium it has been proven to result in. Sponsored Products · Rheem. 32, Grain Preferred Home Water Softener for Hard Water and Iron Reduction · PENTAIR. Water Softener System for 5 to 6 Bathrooms. To take the first step toward deciding on the best water softener for your needs, you can schedule a home water test today. Kenmore Water Softener With High Flow Valve | Reduce Hardness Minerals & Clear Water Iron In Your Home | Whole House | Easy To Install | Grey.

7 Best Water Conditioners of [year] (The Only List You Need). If you're looking for a quality water softener, then these places that offer the best water softeners in Edmonton can help you acquire the right one for your. Purchase a Top-Quality Hard Water Treatment System Online Today Homeowners many reasons to choose iSpring for their water system. Purchase a whole house water. SWS is committed to delivering effective and reliable water quality solutions using the Superior Water Conditioner as its' core technology. APEC or Pentair are good brands IMO. I personally have a GRO 75 alkaline RO from Pentair and a clack 48k water softener. With a water softener. Water conditioners that use TAC media do not require electricity. These systems passively alter the physical structure of the minerals in your water. This means. Insofar as I can tell, the US Water Systems Green Wave, Pelican Water's Natursoft, Aquasana's Salt-Free Water Conditioner, Filtersmart, Smartwell, nextScale. A dual-tank water softener is a salt-based softener with two resin tanks. This style is often the best water softener to use for well water due to its better. API TAP WATER CONDITIONER treatment removes toxins from tap water instantly, so you can add fish to your aquarium (or add them back after a water change). To take the first step toward deciding on the best water softener for your needs, you can schedule a home water test today. We carry a wide range of water softeners, covering a comprehensive array of features. For example, some water softeners use a salt-sensing technology. ecoTAC™ salt-free hard water conditioners are an environmentally-friendly alternative to traditional water softeners to prevent hard water mineral scale from. Of the various types of water softener systems, the most common are ion exchange water softeners, dual-tank water softeners and salt-free water softeners. Ion. Softeners ; 1, A, A. O. Smith - 35,Grain Water Softener System - AO-WH-SOFT · $ ; 2, B-, WaterBoss - WaterBoss Water Softener - · $ ; 3. Whole House Sediment Filter · UV Systems · Water Conditioners We provide our customers with the best Water Filtration Systems for residential. Expert Picks · #1 SpringWell WS Whole House Well Water Filter — Best Overall · #2 Aquasana Rhino UV Well System — Best For Hard Well Water · #3 SoftPro Iron. Water softeners are filtration systems that remove hard minerals from your water. In this review, we evaluate the best water softeners. Water conditioners have often been mistakenly referred to as “salt-free water softeners,” leading to confusion among consumers. However, it's important to. 1. Purifi Water 2. Culligan Water 3. Ecowater Systems Calgary 4. Pure Water Company 5. West Country Pump and Filtration Ltd. 6. BRM Water Conditioning. Superior Water Conditioners offers the best water conditioner option available to remove and control lime scale for residential, commercial, & industrial.

I Need A 30000 Personal Loan

Do you need a $ personal loan? At MONEYME we offer quick, online loans at low rates. Get fast money when you need it, without any paperwork. 30, is ideal for short-term and urgent funding needs. It is a collateral-free offering, meaning that you do not need to pledge any security to avail of the. All credit types can qualify for a $30, personal loan. If you have bad or fair credit we recommend applying with a co-applicant to increase your chance of. Use our Personal Loan Payment Calculator to see what your monthly payments could be. Want to get a personalized rate quote with no impact to your credit score? need, when you need it – and you only have to apply once. With limits ranging from $$30,, you can find an option that works best for you. The Six Best. We can help you get the $30, you need without any hidden fees. We offer unsecured loans with low interest rates and flexible repayment terms. Find out how. How much do you need? Enter your amount to borrow from $1, to $50, The maximum loan amount for those who are not current U.S. Bank customers is $25, To avail instant urgent loan , there are certain eligibility criteria that you need to meet. Firstly, your age should be between years old. Secondly. Securing a $30, personal loan online is not just a dream—it's a reality! Whether you need to finance an emergency, consolidate debt or just buying something. Do you need a $ personal loan? At MONEYME we offer quick, online loans at low rates. Get fast money when you need it, without any paperwork. 30, is ideal for short-term and urgent funding needs. It is a collateral-free offering, meaning that you do not need to pledge any security to avail of the. All credit types can qualify for a $30, personal loan. If you have bad or fair credit we recommend applying with a co-applicant to increase your chance of. Use our Personal Loan Payment Calculator to see what your monthly payments could be. Want to get a personalized rate quote with no impact to your credit score? need, when you need it – and you only have to apply once. With limits ranging from $$30,, you can find an option that works best for you. The Six Best. We can help you get the $30, you need without any hidden fees. We offer unsecured loans with low interest rates and flexible repayment terms. Find out how. How much do you need? Enter your amount to borrow from $1, to $50, The maximum loan amount for those who are not current U.S. Bank customers is $25, To avail instant urgent loan , there are certain eligibility criteria that you need to meet. Firstly, your age should be between years old. Secondly. Securing a $30, personal loan online is not just a dream—it's a reality! Whether you need to finance an emergency, consolidate debt or just buying something.

Borrow up to $30, to consolidate high-interest rate balances into one low monthly payment. To apply for a personal loan, BECU requires a hard credit pull. Wondering if a personal loan is right for you? It's important to ask yourself why you want to borrow money. Is it to pay off bills or move to a city with. Citi® PERSONAL LOANS · Up to $30, loan amount · % - % fixed rate APR · Up to 60 month repayment terms · % rate reduction for enrolling in automatic. Rs. 30, Salary Personal Loan Interest Rates and Charges ; Personal Loan Interest Rate. Starting at 13%* per annum ; Processing Fee. % of the total loan. Use our personal loan calculator to estimate monthly payments for a Wells Fargo personal loan What You Need to Apply · Frequently Asked Questions. Call Us. Example: A $30, boat loan at an % interest rate for 60 monthly payments of $ will have a % APR. 3 Rates as low as % APR (annual percentage. With a Discover personal loan, you can request up to $40, Terms define how long you'll hold the loan and can impact your monthly payment. Be sure you. Generally, you will likely need to have a good credit score (about ) to qualify for a loan of this size. Typically, the lender will do a hard credit. Loan amounts up to $30, with affordable monthly payments and fixed for life rates from % APR to % APR2, no collateral required. Expert Guidance. Eligibility Criteria for ₹ Personal Loan ; Age. 18 years or above ; Citizen of India. Valid PAN & Aadhaar card ; Work experience. Salaried individual ; Monthly. From consolidating debt to funding a major purchase, an unsecured personal loan from U.S. Bank might be just what you need. Apply online now! A personal loan can give you the financial flexibility to take on nearly anything you want to do next in life. Maybe you're ready to start home renovations. Or. For a ₹30, personal loan, you can choose a repayment period that suits your budget and income, ranging from 3 to 36 months. This allows you to select a. All you need to do Simply submit your personal loan application to cash up to $30, After choosing your loan amount, choose your preferred repayment term. How much you can borrow will depend on your financial position and how much flexibility you have in your budget. You'll need to weigh your income versus your. Enjoy all the perks ; Money icon, Borrow as much as $30, · Your Personal Loan is flexible, and you can use it for whatever you need. Don't worry, and don't. Unsecured loan lenders at a glance · LightStream: Best for large unsecured personal loans · Upstart: Best unsecured loans for bad credit · PenFed Credit Union. Get quick access to the money you need. · Personal loan rates as low as % APR · Ways you can use your loan · Personal loan calculator · How to get a personal. Need money for major home improvements? Taking out a £ loan from Tesco Bank could be the answer.

Refinance Or Equity Loan

Freedom Mortgage offers cash out refinances, including cash out refinances on VA and FHA loans. We do not offer home equity lines of credit or home equity loans. A HELOC provides flexibility in borrowing smaller amounts as needed, and a home equity loan offers predictability with fixed payments. Assess your goals and. Key Takeaways. Cash-out refinancing and home equity loans both provide homeowners with a way to get cash based on the equity in their homes. Refinance your existing mortgage to lower your monthly payments, pay off your loan sooner, or access cash for a large purchase. Use our home value estimator to. Conversely, a cash-out refinance replaces your existing mortgage with a new loan. Interest rates also differ; home equity loans typically have fixed rates. Primary Difference Between Each Option. The main difference between a home equity loan and a refinance loan is that the home equity loan is an additional loan. In a mortgage cash-out refinance, you'll replace your existing mortgage with a new home loan—and get the difference between the two in a lump sum of cash. Home equity loans can provide the money you need, while a refinance provides access to your home's equity by taking out a new mortgage. Home equity loans are. Reasons to refinance your home equity loan · Reduce your monthly payment · Lock in a lower interest rate · Switch from an adjustable rate to a fixed rate for more. Freedom Mortgage offers cash out refinances, including cash out refinances on VA and FHA loans. We do not offer home equity lines of credit or home equity loans. A HELOC provides flexibility in borrowing smaller amounts as needed, and a home equity loan offers predictability with fixed payments. Assess your goals and. Key Takeaways. Cash-out refinancing and home equity loans both provide homeowners with a way to get cash based on the equity in their homes. Refinance your existing mortgage to lower your monthly payments, pay off your loan sooner, or access cash for a large purchase. Use our home value estimator to. Conversely, a cash-out refinance replaces your existing mortgage with a new loan. Interest rates also differ; home equity loans typically have fixed rates. Primary Difference Between Each Option. The main difference between a home equity loan and a refinance loan is that the home equity loan is an additional loan. In a mortgage cash-out refinance, you'll replace your existing mortgage with a new home loan—and get the difference between the two in a lump sum of cash. Home equity loans can provide the money you need, while a refinance provides access to your home's equity by taking out a new mortgage. Home equity loans are. Reasons to refinance your home equity loan · Reduce your monthly payment · Lock in a lower interest rate · Switch from an adjustable rate to a fixed rate for more.

As in most things in life, the answer is, it depends. · If you refinance the home, you will get a lower interest rate. · If you get a home. A home equity loan or cash-out refi comes with a fixed interest rate and monthly payment. A HELOC has a variable rate, but more flexibility as a credit. Cash Out Refi - This gets you the money you need but your entire loan Home Equity Loan - The original loan stays as-is, and the new money. What's a Cash-Out Refinance? A cash-out refinance is a new first mortgage with a loan amount that's higher than what you owe on your house, but still within. Learn the key differences between a cash-out refinance and home equity line of credit (HELOC) and see what could be the best option for you. Refinancing means you open a new mortgage to pay off your existing mortgage. With current low-interest rates, refinancing your home can allow you to access. Freedom Mortgage offers cash out refinances, including cash out refinances on VA and FHA loans. We do not offer home equity lines of credit or home equity loans. Use the money any way you'd like! Lower Borrowing Costs. The interest rate on a home equity loan is typically higher than a mortgage refinance rate, but lower. When you refinance, you typically end up paying less every month thanks to a combination of lower rates and/or extended terms. A refinance loan can also help. Blue Water Mortgage Video | Home Equity Line of Credit vs. Cash Out Refinance. An independent mortgage broker serving Ma, NH, Me and Ct, with over years. Refinancing your home equity loan can come with more affordable monthly payments, lower interest rates, and more flexibility with borrowing the equity you've. A cash out refi might mean you lower you rate. e.g if you are already paying $ to close a home equity loan and a cash out refi would be. Unlike a cash-out refi, Home Equity Loans through Connexus often don't require a full appraisal, only an online valuation. There may be closing costs; however. Refinancing your home equity loan can come with more affordable monthly payments, lower interest rates, and more flexibility with borrowing the equity you've. If you're in need of extra buying power and are looking for additional home equity financing, there are no fees to apply for a new line of credit with a higher. Are you looking to get cash out of your home but aren't sure of the differences between a cash-out refinance vs. a home equity loan? Another key difference is that cash-out refinancing typically offers lower interest rates than a home equity loan. Although the up-front cost of a cash-out. This cash-out refinancing vs. home equity loan comparison covers how each loan works for your interest rate, monthly payment, and how to use your equity. You can refinance a home equity loan by replacing it with a new home equity loan or a new home equity line of credit (HELOC) or refinancing into a new.

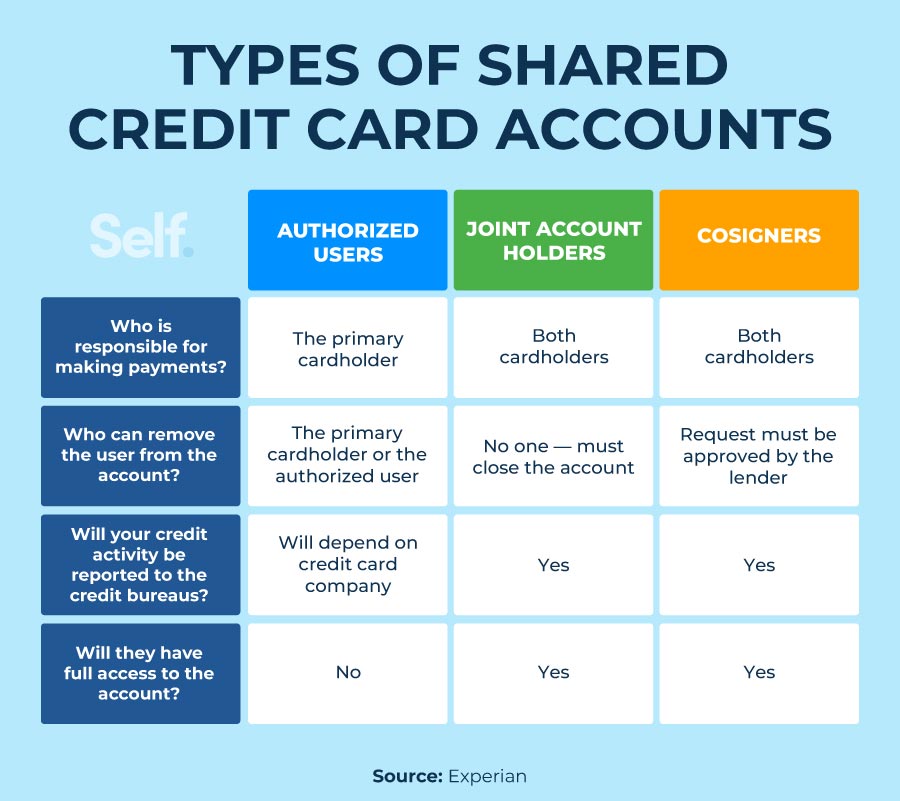

Authorized User Credit Card Score

As an authorized user, your credit score could be built from the positive borrowing activity on the card, assuming the the issuer reports the account activity. Typically you need to be a guarantor of the card in order for any sort of delinquent status to affect your credit. If you are just an authorized user there. Yes being authorized does affect your score. Whether it goes up or down depends on how the card is used. With your dad having good credit it. An authorized user on your credit card account can be given the right to use your account, or they can be added simply to help build their credit scores. They. A. Being an authorized user on a credit card in good standing can be a good strategy for improving your credit. However, technically, authorized user accounts. The good news is the authorized user's credit report, credit score, payment history, debt, and other factors will not affect the primary card holder's credit. However, they have no legal responsibility toward the debt. Authorized users also gain access to most of the credit card's benefits, such as airport lounge. For example, Discover requires authorized users to be at least 15 years of age. Also know you may be subject to an annual fee for the authorized user account. Adding an authorized user doesn't affect your score. BUT, they will send a card in the mail in their name and you don't want to give them this. As an authorized user, your credit score could be built from the positive borrowing activity on the card, assuming the the issuer reports the account activity. Typically you need to be a guarantor of the card in order for any sort of delinquent status to affect your credit. If you are just an authorized user there. Yes being authorized does affect your score. Whether it goes up or down depends on how the card is used. With your dad having good credit it. An authorized user on your credit card account can be given the right to use your account, or they can be added simply to help build their credit scores. They. A. Being an authorized user on a credit card in good standing can be a good strategy for improving your credit. However, technically, authorized user accounts. The good news is the authorized user's credit report, credit score, payment history, debt, and other factors will not affect the primary card holder's credit. However, they have no legal responsibility toward the debt. Authorized users also gain access to most of the credit card's benefits, such as airport lounge. For example, Discover requires authorized users to be at least 15 years of age. Also know you may be subject to an annual fee for the authorized user account. Adding an authorized user doesn't affect your score. BUT, they will send a card in the mail in their name and you don't want to give them this.

It can be relatively low-risk and allows you to build or boost your credit score. But before you sign up there are some things you should know. Below, CNBC. They also have access to the card yet have no liability to pay. The advantage of being an authorized user is if the person has excellent payment/ card history. If you become an authorized user on someone else's credit card because they have a good credit history, but then the cardholder starts paying late, defaults or. Only a primary cardholder can add an authorized user to their card. To do so, you'll generally go through the following steps: 1. Notify your credit card issuer. Whenever you are using a credit card (or when the principal user uses it) you will build a better credit score. It is fundamental to remember. An Authorized User needs to be at least 15 years old and can be any family member, friend or person whom the primary cardholder trusts. Hide All Show All. An authorized user is a person who is allowed to use another person's credit card account (the primary cardmember, otherwise known as the card owner). As an authorized user, your credit score could be built from the positive borrowing activity on the card, assuming the the issuer reports the account activity. Adding an authorized user on your account does not impact your credit score. Click to Show/Hide Is there a cost to add an authorized user to my account? When you add an authorized user, they'll get a credit card in their name with a unique credit card number. There are two levels of access you choose when adding. No, adding to someone with bad credit as an authorized user on your credit card will not hurt your credit. However, if this person has the. Adding an authorized user doesn't affect your score. BUT, they will send a card in the mail in their name and you don't want to give them this. Authorized user accounts can appear on your credit report and impact your FICO® Score. This means that both positive and negative information can impact the. While adding someone as an authorized user can help that person's credit score, it is usually used as a temporary measure designed to transition that person. Potential for damage to your credit: If an authorized user runs up charges you have trouble paying, you could see a drop in your credit score. You might end up. Becoming an authorized user generally depends on two things: the account holder and the credit card issuer. Issuers may have rules about who can be added or. It can be relatively low-risk and allows you to build or boost your credit score. But before you sign up there are some things you should know. Below, CNBC. Think of it as creating a soft credit score. Being reported as an authorized user doesn't necessarily increase your chances of being approved for other lines of. Comparing Your Options ; Number of cardholders, Can add 1 Co-Applicant to your account, Can add up to 9 Authorized Users ; Age of cardholders, Primary and Co-. Learn how to get your first credit account and build a credit history that is reported on a credit report. Credit can help you get a loan, credit card, job.

Mass Investors Growth Stock Fund A

The investment seeks capital appreciation. The fund normally invests at least 80% of the fund's net assets in stocks. MFS may invest the fund's assets in foreign securities. MFS normally invests the remaining investors' interests in the fund. The prices of illiquid. The fund normally invests at least 80% of the fund's net assets in stocks. Stocks include common stocks and other securities that represent an ownership. Get the latest news, data and filings for MFS Massachusetts Investors Growth Stock Fund (MIGHX), with free alerts. Includes transcripts, social sentiment. The MFS MIGFX Massachusetts Investors Growth Stock Fund summary. See MIGFX pricing, performance snapshot, ratings, historical returns, risk considerations. Detailed Profile of MASSACHUSETTS INVESTORS GROWTH STOCK FUND portfolio of holdings. SEC Filings include 13F quarterly reports, 13D/G events and more. Analyze the Fund MFS Massachusetts Investors Growth Stock Fund Class A having Symbol MIGFX for type mutual-funds and perform research on other mutual funds. MFS Massachusetts Investors Growth Stock Fund;A | historical charts and prices, financials, and today's real-time MIGFX stock price. The fund seeks large-cap growth at a reasonable price. The fund aims to invest in businesses with strong fundamentals, top-notch management and a sustainable. The investment seeks capital appreciation. The fund normally invests at least 80% of the fund's net assets in stocks. MFS may invest the fund's assets in foreign securities. MFS normally invests the remaining investors' interests in the fund. The prices of illiquid. The fund normally invests at least 80% of the fund's net assets in stocks. Stocks include common stocks and other securities that represent an ownership. Get the latest news, data and filings for MFS Massachusetts Investors Growth Stock Fund (MIGHX), with free alerts. Includes transcripts, social sentiment. The MFS MIGFX Massachusetts Investors Growth Stock Fund summary. See MIGFX pricing, performance snapshot, ratings, historical returns, risk considerations. Detailed Profile of MASSACHUSETTS INVESTORS GROWTH STOCK FUND portfolio of holdings. SEC Filings include 13F quarterly reports, 13D/G events and more. Analyze the Fund MFS Massachusetts Investors Growth Stock Fund Class A having Symbol MIGFX for type mutual-funds and perform research on other mutual funds. MFS Massachusetts Investors Growth Stock Fund;A | historical charts and prices, financials, and today's real-time MIGFX stock price. The fund seeks large-cap growth at a reasonable price. The fund aims to invest in businesses with strong fundamentals, top-notch management and a sustainable.

MIGHX | A complete MFS Massachusetts Investors Growth Stock Fund;R3 mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and. A shareholder can obtain the portfolio holdings report for the first and third quarters of the fund's fiscal year at rogervivieroutlet.ru by choosing the fund's. Interactive stock price chart for MFS Massachusetts Investors Growth Stock Fund Class A (MIGFX) with real-time updates, full price history. Growth companies tend to have stock prices that are high relative to Massachusetts Investors Trust. Net assets under the management of the MFS. The Fund seeks to provide long-term capital growth and future income by keeping its assets invested, except for working cash balances, in the common stock or. MIGFX - MFS Massachusetts Inv Gr Stk A - Review the MIGFX stock price, growth, performance, sustainability and more to help you make the best investments. The investment seeks capital appreciation. The fund normally invests at least 80% of the fund's net assets in stocks. Stocks include common stocks and other. The fund normally invests at least 80% of the fund's net assets in stocks. LCMGX Lord Abbett Micro Cap Growth Fund. +%. AGCHX American Century. MFS Massachusetts Investors Growth Stock Fund;A | historical charts and prices, financials, and today's real-time MIGFX stock price. Get MFS Massachusetts Investors Growth Stock Fund Class R6 (MIGNX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. High quality focused large-cap growth fund that seeks resilient companies with long-term competitive advantages. Invest with long-term horizon. Massachusetts Investors Growth Stock Fund (the fund) is organized as a Massachusetts business trust and is registered under the Investment Company Act of Schwab Mutual Fund Report Card™ as of 7/31/ MIGFX. MFS Massachusetts Investors Growth Stock Fund Class A. NO LOAD. NO FEE. Schwab Mutual Fund OneSource®. . MIGFX: Massachusetts Investors Growth Stock Fund Class A - Class Information. Get the lastest Class Information for Massachusetts Investors Growth Stock. At period end, the aggregate values of the fund's investments in affiliated issuers and in unaffiliated issuers were $56,, and $8,,, Key Statistics MFS Massachusetts Investors Growth Stock Fund is an open-end fund incorporated in the USA. The Fund's objective is long-term growth of capital. Massachusetts Investors Growth Stock Fund Class A (MIGFX) Dividends Dates And Yield - See the dividend history dates, yield, and payout ratio for. MFS Massachusetts Investors Growth Stock Fund A (MIGFX) dividend growth history: By month or year, chart. Dividend history includes: Declare date, ex-div. MIGFX - Massachusetts Investors Growth Stock Fund A has disclosed 56 total holdings in their latest SEC filings. Most recent portfolio value is calculated. MFS Massachusetts Investors Growth Stock Fund Class. R6 (06/12). MIGNX. Voya Large-Cap Growth Fund Class I (01/02).

Best Investment Option For 5 Years

Real estate can be a solid investment choice if the investor plans to stay there for longer than five years. Unlocking the Great Wealth Transfer: 5 Tips to. This Investment Option seeks to achieve its investment objective by investing 5 years. Speak to a tax advisor to review and understand the 10% Early. CDs provide reliable, fixed-rate returns on a lump sum of money over a fixed period of time, such as 6 months, 1 year, or 5 years. You can get a traditional. Mutual funds are diversified portfolios of stocks, bonds and other investments chosen by a fund manager to achieve a stated objective. Each fund is assigned a 5. For example, the 5-year U.S. Treasury note yielded % at the end of ; by April , the yield was %. Chart depicts Treasury yields in December 5-Yrs National Savings Certificate (NSC) NSC allows you to invest your hard-earned money in postal NSC for 5 years, but only if you ensure that the goal is. "Do you want a travel fund? Are you going to get married? Do you want to buy a home in five or 10 years? Do you want a tattoo?" she asks. Each one of your. by the end of 5 years, and by the end of 30 years, to $1, That's the The broker relies on this information to determine which investments will best. What are the best investments for retirement? Guaranteed Investment Certificates (GICs) are a common choice, as they are worry-free investment products that. Real estate can be a solid investment choice if the investor plans to stay there for longer than five years. Unlocking the Great Wealth Transfer: 5 Tips to. This Investment Option seeks to achieve its investment objective by investing 5 years. Speak to a tax advisor to review and understand the 10% Early. CDs provide reliable, fixed-rate returns on a lump sum of money over a fixed period of time, such as 6 months, 1 year, or 5 years. You can get a traditional. Mutual funds are diversified portfolios of stocks, bonds and other investments chosen by a fund manager to achieve a stated objective. Each fund is assigned a 5. For example, the 5-year U.S. Treasury note yielded % at the end of ; by April , the yield was %. Chart depicts Treasury yields in December 5-Yrs National Savings Certificate (NSC) NSC allows you to invest your hard-earned money in postal NSC for 5 years, but only if you ensure that the goal is. "Do you want a travel fund? Are you going to get married? Do you want to buy a home in five or 10 years? Do you want a tattoo?" she asks. Each one of your. by the end of 5 years, and by the end of 30 years, to $1, That's the The broker relies on this information to determine which investments will best. What are the best investments for retirement? Guaranteed Investment Certificates (GICs) are a common choice, as they are worry-free investment products that.

1. Public Provident Fund (PPF) · 2. Voluntary Provident Fund (VPF) · 3. Unit Linked Insurance Plans (ULIPs) · 4. Equity Linked Savings Schemes (ELSS) · 5. National. 27 Investment Plans to choose from · Public Provident Fund (PPF) · Mutual Funds · Direct Equity · Real Estate Investment. You can only access a portion of your investment once per tax year At least 5 years, ideally longer. chart Since inception % per year; scale. Best. Fund name. VSCGX LifeStrategy Conservative Growth Fund ; Investment time horizon. More than 5 years ; Target allocation 40% stocks 60% bonds ; Risk potential. Tata Digital India Fund Direct-Growth Tata Digital India Fund Direct-Growth is an equity mutual fund scheme offered by Tata Mutual Fund. The plan is currently. Hold the money in a relatively safe, liquid account, such as an interest-bearing bank account or money market fund. Two to four years' worth of living expenses. Life of Fund5 year3 year. Life of Fund. Important Information About This Investment. The Vanguard Ohio Target Enrollment Portfolio uses a carefully balanced. Masterclass Minutes · Principle 1: Get started · Principle 2: Invest regularly · Principle 3: Invest enough · Principle 4: Have a plan · Principle 5: Diversify. 5 Years. 10 Years. RETIREMENT DATE FUNDS. FRS Retirement Date Fund According to investment experts, a good mix of investments (a strategy known as. National Savings Certificate or NSC is a post office savings product backed by the government of India. It works like a 5-year FD. It offers you guaranteed. Mutual funds are similar to ETFs. They pool investors' money and use it to accumulate a portfolio of stocks or other investments. The biggest difference is that. Long term: 5 years or more. Retirement, your child's post-secondary education A long-term, tax-sheltered savings and investment option for Canadians with. Save for anything you want in the next few years⎯an emergency fund, a car, renovation or retirement. What is it? A registered savings plan where investment. 5. Create and maintain an emergency fund. Most smart investors put enough money in a savings product to cover an emergency, like sudden unemployment. Some make. Average return over last 10 years: % per year (Australian shares); Risk: high; Time frame: long term, at least 5 years. Alternative investments. Includes. For the best For hands-off investing. Target Date. Think of Fidelity ClearPath® Retirement Portfolios as an investment option with your retirement year in. Tata Digital India Fund Direct-Growth Tata Digital India Fund Direct-Growth is an equity mutual fund scheme offered by Tata Mutual Fund. The plan is currently. Choose the option that works best for you. Target Enrollment Date Net Asset Value. Select Date Range: Custom, 1 Month, 6 Months, Year to Date, 1 Year, 5 Year. Which are the Best Investment Plans for 5-years in India? · ULIPs · Traditional Plans · Recurring Deposits: · Monthly Income Schemes: · Fixed Deposits: · Savings. Here are a few of the best options. How to Invest in Index Funds Canada in By Luisa Rollenhagen. 5 min read. Index funds function like a slice of a.

Average Cost Of Auto Insurance In Texas For One Vehicle

The average rate of insurance for Texas drivers is $1, per year. • Auto insurance rates jumped more than 25% last year, partly due to risky driving, the rise. In , the average monthly cost for Progressive commercial auto insurance ranged from $ for contractor autos to $ for for-hire transport trucks. In Texas, Married couple typically pay around $ per month while single drivers average in around $ per month. Marital Status, Avg monthly rate. According to the American Auto Association (AAA), the average cost to insure a mid-size sedan in was $ a year, or approximately $ per month. How Much Does Texas Auto Insurance Cost? The average Texan pays about $1, per year for full coverage auto insurance or $ per year for minimum-coverage. How much does an auto insurance policy cost in Texas? According to Bankrate the average cost of minimum coverage is $ annually. For full coverage, Texas. The average cost of full coverage, including comprehensive and collision, is $1, per year or $ per month. Of course, you'll want to keep in mind that. For a liability-only policy from Progressive, car insurance costs an average of $ per month in medium-cost states like Texas. That said, your insurance. On average, car insurance from some of the top insurance carriers in the nation ranges from around $1, to $2, per year for full coverage, some of the. The average rate of insurance for Texas drivers is $1, per year. • Auto insurance rates jumped more than 25% last year, partly due to risky driving, the rise. In , the average monthly cost for Progressive commercial auto insurance ranged from $ for contractor autos to $ for for-hire transport trucks. In Texas, Married couple typically pay around $ per month while single drivers average in around $ per month. Marital Status, Avg monthly rate. According to the American Auto Association (AAA), the average cost to insure a mid-size sedan in was $ a year, or approximately $ per month. How Much Does Texas Auto Insurance Cost? The average Texan pays about $1, per year for full coverage auto insurance or $ per year for minimum-coverage. How much does an auto insurance policy cost in Texas? According to Bankrate the average cost of minimum coverage is $ annually. For full coverage, Texas. The average cost of full coverage, including comprehensive and collision, is $1, per year or $ per month. Of course, you'll want to keep in mind that. For a liability-only policy from Progressive, car insurance costs an average of $ per month in medium-cost states like Texas. That said, your insurance. On average, car insurance from some of the top insurance carriers in the nation ranges from around $1, to $2, per year for full coverage, some of the.

The average full-coverage insurance cost for medium sedans was $1,, compared with $1, for a medium SUV. The average insurance cost for all vehicles. If you're at fault for an accident resulting in injuries, for instance, your average car insurance rate in Texas goes up to $4, per year. Other factors that. Average Monthly Auto Insurance by Relationship Status ; Relationship. Av. Monthly Premium ; Single (never married). $60 ; Married. $51 ; Divorced. $51 ; Widowed. $ Multi-car discount: Save when you insure more than one vehicle with Mercury. What is the average cost of auto insurance in Houston? According to Value. What's the average cost of car insurance in Texas? The average cost of liability-only car insurance for Texas drivers is $ per month, or $1, per year. What most of our customers pay for Commercial Auto insurance? · Under $ 11% of customers · $75 to $ 9% of customers · $ to $ 23% of customers · $ The state average for the minimum liability insurance coverage in Texas is $ per year – or $55 monthly. This amount is about $ more expensive than the. Bodily Injury Liability. Should you be held legally responsible, this coverage pays for injuries or death to another person, and related costs arising out of a. Despite declining claim numbers, rates have climbed from $ in to $ per year currently. That's good enough for the second-lowest average insurance. The average cost of car insurance ranges from $ to $ per month for a liability-only policy from Progressive. The average cost of car insurance in Texas was $1, in according to rogervivieroutlet.ru That's 4% higher than the national average. Of course, your auto. If you're at fault for an accident resulting in injuries, for instance, your average car insurance rate in Texas goes up to $4, per year. Other factors that. In working with thousands of Texas car insurance policyholders, Jerry has found that the average cost of minimum liability coverage is $ per month or $1, For a liability-only policy from Progressive, car insurance costs an average of $ per month in medium-cost states like Texas. That said, your insurance. Car insurance quotes in Texas. The average cost for full coverage car insurance in Texas is $ for a six-month policy — that's 18% more expensive than. Your responses will help you get the right level of protection for a great price. Learn more about factors that impact your car insurance coverage needs. The. What most of our customers pay for Commercial Auto insurance? · Under $ 11% of customers · $75 to $ 9% of customers · $ to $ 23% of customers · $ In Texas, the average annual cost for full coverage car insurance is $1,, which is higher than the national average. For minimum liability coverage, the. We offer competitive auto insurance rates from family cars to work trucks and all vehicles in between - for every moment of every mile.

Bank With The Most Branches In The Us

Nonetheless, its prominence as one of the largest corporations in America and its branches most clearly in the Bank's interactions with state banks. In. JPMorgan Chase & Co. had assets of $ trillion in which makes it the largest bank in the United States as well as the bank with the most branches in the. More than 70, employees. Our culture is among our greatest strengths. Explore careers ; More than 2, branches in 26 states. We're a neighborhood bank in. The biggest institutions are closing the most branches, the 25 largest banks closed 1, branches. banks opened almost 1, branches in the U.S. in the last. largest foreign-based employers in New York City. Deutsche Bank launched its US intermediate holding company, DB USA Corporation, on July 1, , under which. Financial Institutions. As the oldest and largest Chinese bank in the U.S., Bank of China U.S.A. provides comprehensive services for financial institutions in. JPMorgan Chase is the largest US bank by assets, according to the latest release from The Federal Reserve Board. Here is the full list of the top 10 banks in. Shanghai, China | Bank of America, National Association Shanghai Branch. 55th Floor, International Finance Center, Tower 2. Key Takeaways · The five largest banks by market capitalization are JPMorgan Chase, Bank of America, Industrial and Commercial Bank of China, Wells Fargo, and. Nonetheless, its prominence as one of the largest corporations in America and its branches most clearly in the Bank's interactions with state banks. In. JPMorgan Chase & Co. had assets of $ trillion in which makes it the largest bank in the United States as well as the bank with the most branches in the. More than 70, employees. Our culture is among our greatest strengths. Explore careers ; More than 2, branches in 26 states. We're a neighborhood bank in. The biggest institutions are closing the most branches, the 25 largest banks closed 1, branches. banks opened almost 1, branches in the U.S. in the last. largest foreign-based employers in New York City. Deutsche Bank launched its US intermediate holding company, DB USA Corporation, on July 1, , under which. Financial Institutions. As the oldest and largest Chinese bank in the U.S., Bank of China U.S.A. provides comprehensive services for financial institutions in. JPMorgan Chase is the largest US bank by assets, according to the latest release from The Federal Reserve Board. Here is the full list of the top 10 banks in. Shanghai, China | Bank of America, National Association Shanghai Branch. 55th Floor, International Finance Center, Tower 2. Key Takeaways · The five largest banks by market capitalization are JPMorgan Chase, Bank of America, Industrial and Commercial Bank of China, Wells Fargo, and.

Associated Bank is the largest Wisconsin-based bank.¹ Our rich history traces all the way back to From a small set of financial institutions that. Banks Ranked by Number of Branches ; 1, 5,, JPMorgan Chase Bank ; 2, 4,, Wells Fargo Bank ; 3, 3,, Bank of America ; 4, 2,, PNC Bank ; 5, 2,, U.S. Shanghai, China | Bank of America, National Association Shanghai Branch. 55th Floor, International Finance Center, Tower 2. M&T Bank provides banking, insurance, investments, mortgage, and commercial financial services through branches, 1, ATMs, and a variety of online and. The only 2 that come to mind are Wells Fargo and Bank of America. They both have very large branch networks. Most others belong to the super. Select Report Filters ; , United States & Other Areas, 7,, 82,, 91 ; , United States & Other Areas, 7,, 78,, most respected banks in America. Award-winning relationship banking. Comerica – Acquires Imperial Bank in California and its Arizona branches. Find a City National Bank Bank, ATM, or banking office in the United States and get help with everything from everyday deposits to opening a CD. Fifth Third Bank. in United States Deposit and credit products provided by Fifth Third Bank, National Association. Member FDIC. Fifth Third Bank is part of a. Find a City National Bank Bank, ATM, or banking office in the United States and get help with everything from everyday deposits to opening a CD. National Banks & Federal Branches and Agencies active as of 7/31/ sorted U.S. Treasury · Freedom of Information Act (FOIA) · No Fear Act Data. Financial Institutions. As the oldest and largest Chinese bank in the U.S., Bank of China U.S.A. provides comprehensive services for financial institutions in. Fifth Third Bank. in United States Deposit and credit products provided by Fifth Third Bank, National Association. Member FDIC. Fifth Third Bank is part of a. Wells Fargo is one of the largest banks in the United States, currently the 2nd largest bank in America by the number of branches. It competes with Chase. Here's what you can do at most U.S. Bank ATMs, besides withdraw cash: Check Which states have U.S. Bank branches? Arizona · Arkansas · California. Bank of America Private Bank provides comprehensive wealth management services and customized financing solutions to meet your private banking needs. TD has hundreds of ATM and branch locations across US. Use our branch TD Bank America's most convenient bank. Log In Open Menu. Log In. TD Bank. Bank deposit products, such as checking, savings and bank lending and related services are offered by JPMorgan Chase Bank, N.A. Member FDIC. Not a commitment to. HSBC, one of the world's largest banking and financial services organizations, has been connecting Americans to global opportunities since Welcome to Bank of America's financial center location finder. Locate a financial center or ATM near you to open a CD, deposit funds and more.